EMC’s considerable track record of success in acquiring and integrating technology companies attracts the interest of people who want to know why EMC is so successful with Mergers and Acquisitions (M&A). Here are answers to some of the most frequently asked questions:

EMC’s considerable track record of success in acquiring and integrating technology companies attracts the interest of people who want to know why EMC is so successful with Mergers and Acquisitions (M&A). Here are answers to some of the most frequently asked questions:

Why does EMC acquire companies? EMC pursues acquisitions as an additional way to accomplish strategic objectives. EMC today is one of a select few companies that focus nearly identical resources on organic growth initiatives (through R&D) and inorganic growth initiatives (through acquisitions). This balance is important, because EMC doesn’t overcommit to any single route to achieving its objectives. EMC acquired growing businesses and technologies to accelerate EMC’s growth and is a serial innovator in its own right.

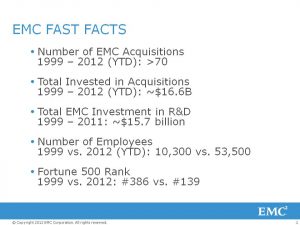

Acquisitions are important to EMC for a wide variety of reasons. The 70 or so acquisitions EMC has made since 1999 have added new technologies (features/functions/capabilities), accelerated business momentum and time to market, brought critical leadership talent, expanded EMC’s market opportunities and increased EMC’s customer relevance – all which have delivered significant value to EMC.

How does EMC evaluate acquisition opportunities? EMC reviews acquisition opportunities within the context of a business strategy. That strategy might belong to a business unit or to EMC as a whole. Adhering to and executing against strategic objectives ensures that EMC’s acquisition process does not merely react to opportunities that arise from time to time. Once EMC identifies a good strategic fit, a potential acquisition must pass additional hurdles, including the creation and approval of a business plan, the forecast delivery of acceptable financial returns, deep technology and architectural evaluations, and the negotiation of mutually acceptable legal agreements.

What does EMC look for in acquisition candidates? EMC does not have fixed criteria that it seeks in every acquisition. Each acquisition opportunity is unique. However, characteristics that correlate with our track record of success include:

- Shared cultural attributes, such as a relentless focus on the customer, demand for consistent execution across the business, and results-driven performance

- Best-in-class technologies

- Top industry leaders who are interested in accelerating their growth and opportunity within EMC’s larger organization.

What is EMC’s integration model for acquired companies? EMC does not have one model for integration. One unique EMC strength is a proven ability to avoid a uniform approach to acquisitions and business integration. Instead, EMC focuses carefully on the best way to accelerate the growth and development of each acquired business or technology. From Data General to VMware, Documentum, RSA, Data Domain, Greenplum and Isilon, EMC has developed a long and successful track record of flexible and unique integration approaches designed to maximize opportunities for the success of each acquired business.

How big is EMC’s acquisition team? EMC’s Corporate Development team is relatively small. The number of people who work on acquisitions across EMC, however, is very significant and includes people from every business unit and every functional organization. A large part of EMC’s hard-earned reputation as a preferred acquirer comes from EMC’s company-wide commitment to post-acquisition success. Accelerating the growth of acquired businesses is part of who we are as a company. The work of broad-based teams across a wide range of disciplines to identify the right integration model for each transaction and to marshal the resources to execute that model aggressively and efficiently is an impressive differentiator for EMC. As a result, potential acquisition targets value EMC as a potential acquirer above many other companies.

What is EMC’s next acquisition? I can’t say who EMC will acquire next, but I can say that EMC has developed an acquisition process that is so engrained in our culture and our business processes that future acquired companies will have every opportunity and all the support necessary to succeed as part of EMC.