Market share results are generally seen as a key barometer of customers’ trust in a company, its vision and its technology. That’s why it’s been so great to see us take market share on both the storage and data protection fronts over the past year.

Increasingly, our storage and data protection products are being designed together to drive efficiency, automation and cost savings into customer environments.

Storage and data protection share many of the same challenges and, going forward, people will think more holistically about them, provisioning storage and data protection as a single entity.

Multiple Results… One Story of Growth

IDC’s most recent Worldwide Storage Software report shows EMC taking market share for the third consecutive year, finishing 2013 with a market-leading position and over 25% market share.

Similarly, IDC’s latest Worldwide External Disk Storage System report reflects that EMC took market share for the fourth year in a row, eclipsing the 30% percent share mark at the close of 2013, which is more than double share of its nearest competitor. So, we see not only storage market leadership, but perhaps even more importantly, we see multiple years of EMC storage market share expansion.

For the Data Protection market, the two primary industry benchmarks are IDC’s Purpose-Built Backup Appliance (PBBA) and Data Protection and Recovery software reports.

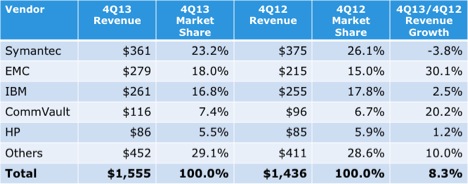

On the Data Protection and Recovery Softwarefront, according to IDC:

- In the fourth quarter of 2013, we grew our software business 30.1% year-over-year.

- Outpaced the growth rates of the top four vendors.

- We moved into the #2 spot in terms of market share – gaining 3 points of market share.

Here’s a table depicting Top 5 Vendors, Worldwide Data Protection and Recovery Software Revenue, Fourth Quarter of 2013 (Revenues in $ Millions):

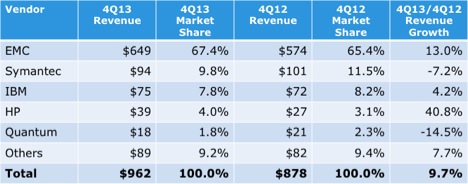

On the storage appliance side, according to IDC, EMC continues to lead the PBBA market, gaining 2 points and registering a 67.4% market share in the fourth quarter of 2013. For context, that puts EMC at well over six times that of our nearest competitor.

Here’s a table depicting Top 5 Vendors, Worldwide PBBA Factory Revenue, Fourth Quarter of 2013 (Revenues in $ Millions)

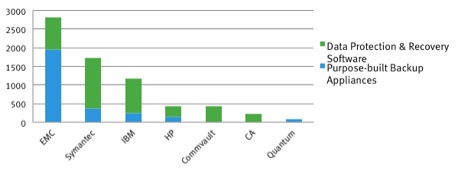

Finally, here’s yet another picture of where the overall data protection market stood at year’s end (yes, we are indeed the world’s largest data protection company):

The gains we made in Q4 cap off an excellent year, and they go a long way in validating the journey we’re on with our customers. And, boy, are we on a journey.

Guy Churchward was right on the mark when he said in the first of his Second Machine Age posts, “Fasten your seatbelts; the ride is about to get interesting!”