Many CIOs today focus their attention in two key areas:

- Increasing agility in deploying and delivering enterprise applications to business constituents

- Re-architecting the data center to be more cost-effective and efficient by bringing databases into the fold vs. being a silo

Imagine a CIO at a large financial institution – their customers are global, whether they are individual traders or financial institutions that manage huge pension funds. They demand instant access to their services to trade and manage funds in real time. The underlying infrastructure, including databases, must process millions of transactions each minute with near zero downtime to keep them not only viable, but also profitable.

Just a millisecond reduction in response time could result in decreased profits for a financial services organization and could mean an economic disaster for their customers.

This CIO’s data centers are not only mission-critical to the financial trading company, but to the broader economy. Countries, enterprises and individual consumers could be financially devastated if the institution’s database went offline for a few minutes, rendering millions of transactions incomplete. As the CIO, the customers’ trust and company’s reputation live and die with the speed, reliability, agility and availability of the data center.

Another important requirement is security and data protection. For example, financial organizations are expected to meet the Dodd-Frank Wall Street Reform and Consumer Protection Act, which is a regulatory compliance law that enforces transparency, accountability and consumer protection for financial processes – such as trades and settlements.

Regulatory requirements weigh heavily on CIOs; trading institutions must save records for five years, which requires massive amounts of data to be backed up, archived and retrieved at a moment’s notice. Traditional infrastructure methods for record retrieval can take days or even up to several weeks to access across multiple archived silos, resulting in delayed response to audits or internal investigation needs. Additionally, new regulation requiring intraday liquidity management reporting and compliance are driving more demands for large, agile system deployments.

Without a doubt, addressing the high performance and low latency needs of business applications including databases as well as security and availability in the data center are all essential factors for keeping these businesses viable and profitable. But a financial trading institution CIO is also looking to re-architect his or her data center to be more efficient to lower costs.

In the past, CIOs kept mission-critical business applications on isolated Oracle, SAP or Microsoft databases because of their unique requirements for high performance, availability and reliability, but that paradigm is shifting. It’s no longer cost-effective or efficient for the trading institution to host 200+ applications on numerous databases, as well as:

- Multiple (regional/geographic) instances

- Excessive heterogeneity/lack of standards

- Overlapping functionality

- Multiple operational/management solutions

- Increased risk of data loss/security breaches

- Difficult and costly regulatory reporting

- Increased capital and operational costs

Consolidation of business applications and databases is becoming the norm.

As the leader for Integrated Infrastructure Systems,[footnote]Gartner Market Share Analysis: Data Center Hardware Integrated Systems, 2013 and http://www.vce.com/landing/gartner[/footnote] VCE converged infrastructure helps customers deliver business applications and services faster while consolidating data centers to be more cost-effective and efficient. Databases are one of the top workloads that are deployed on VCE Vblock Systems today and we have a broad portfolio of systems to address their needs.

VCE Vblock® Specialized Systems for High Performance Databases is specifically tuned to enable financial institutions and other enterprise customers to meet the highest performance, reliability and availability requirements for online transaction processing (OLTP) and online analytical processing (OLAP) while helping to reduce risk and costs. The system also lowers the time it takes to recall archives – from several weeks to only two or three minutes (or even less).

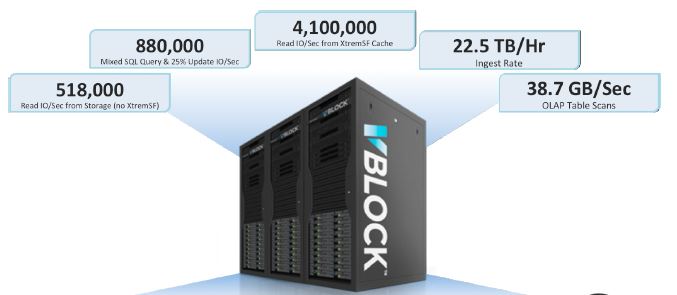

The Enterprise Strategy Group (ESG), an independent industry analyst firm, recently performed an ESG Lab validation of the Vblock Specialized Systems for High Performance Databases, finding that VCE provides:[footnote]ESG Lab Review, Vblock Specialized Systems for High Performance Databases, October 2014[/footnote]

- Extremely high throughputs of 4.1 million sustained read IOPS per second

- 22.5 terabytes per hour data load rate to migrate to new environment

- 38.7 gigabytes per second table scans providing faster insights into data

- Application Latency <700 microseconds against 11.2 terabytes of data

VCE also enables financial institutions to utilize the same infrastructure resources for consolidating other enterprise applications in the data center (e.g., internal or backend marketing applications). The ESG Global report found that this specialized system is ideal for consolidating non-Oracle applications, multiple Oracle databases, even those with different versions, all of which aid in minimizing deployment, upgrades, licensing and on-going operational costs.